Perseverance beats the poverty trap

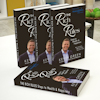

Doggedness is a word which hardly seems to begin to describe British mega-landlord Kevin Green.

As a Nuffield student, he wangled his way into an interview with Virgin’s Richard Branson by finding his address and knocking on his door until he was home.

He also doorstopped Microsoft founder Bill Gates by flying to Las Vegas and posing as a reporter at an electronics convention.

Green wanted to interview both men because he felt they had something to teach him beyond what he knew as a dairy farmer. And the property market was where he found his niche.

Green, who has featured on British television series Secret Millionaire, is in New Zealand for a wedding and a public address in Auckland on Wednesday.

With a property portfolio worth $144 million, he is said to be one of Britain’s biggest residential landlords, as well as the owner of several unrelated businesses and a registered building society.

Having his own bank helps lower his funding costs, he admits, but it’s a far cry from the late 1990s when he stepped out to buy his first property, and then another 79.

“I’m the type of person that if you’re going to do it, you’re gonna do it properly and hit it hard,” he says.

For the first year, he drank no alcohol and averaged four to five hours’ sleep a night as he established his rental business.

Banks were happy to lend to him because of his formula – buy three properties, hold two and sell one.

“The fact I was trading quite strongly alongside holding was showing my ability to clear capital debt. A mistake a lot of investors make is they don’t ever sell . . . but that stagnates the borrowing capacity that you’ve got.

“It keeps the lenders happy.”

Green holds a number of other principles. He runs several simple businesses with high cashflow to complement his property interests.

He buys properties for cashflow rather than capital gain, adds value and clears the mortgages. His ideal yield is at least 4 per cent above the mortgage interest rate.

“It’s not necessarily the number of properties that you own . . . it’s the amount of money that each property’s producing in profit for you.”

Green also never remortgages a property. Any gearing beyond 60 per cent is viewed as unsustainable by banks, he says.

When it comes to the New Zealand property market, Green says Auckland and even Wellington’s rental yields appear to be rising quite strongly, but investors should be prepared for a cyclical downturn.

“There will be a property crash at some stage.”

Green says he saw the 2008 British property crash coming when house prices far outstripped annual salaries. A normal UK ratio of home affordability is that it takes six years of median income to buy one house, but it rose to nearly eight during the height of the boom.

New Zealand’s ratio is 5.7 years, according to the recent Demographia housing affordability survey. “In any other historic markets, if the house price-salary ratio goes out of line it has to be corrected, and this is why I would be very wary of the New Zealand market, although it’s very strong at the moment.”

Green avoided the British crash by ensuring half of his portfolio was in shared housing, which mitigated much of the risk of having houses untenanted.

Rents increased and prices dropped, enabling him to snap up bargains.

“We’d also by that point in time got our own lending business in place so I could decide what interest rate I charged myself each day, which was linked to how much I could buy the money in for.”

Green might be worth a bit now, but the Welshman has known poverty after running away from home as a teenager.

After several months of homelessness, he found himself a job as a dairy manager, and in two years was running three farms. He later won a Nuffield rural leaders scholarship because he didn’t want to be milking cows all his life.

“So I won a Nuffield to study the attitudes and personalities of achievers in business, with a view to answering my own question as well: what I am going to do next?”

Branson, he said, was out of town when he door-knocked his house the first three times.

But his persistence paid off and Branson even agreed to mentor him.

Gates was not giving interviews, but Green managed to find out where he was appearing and bluffed his way into the press room as a reporter for the “Nuffield News”.

After waiting for several hours he pounced on Gates at the Microsoft stand. “He answered six of my questions straight away and then passed me on to his PA, who then said to me, ‘email the rest of them and I’ll get it sorted for you’. Which he did.”

Green believes having a good role model or mentor is crucial to gaining the self-confidence to move ahead. “One of the turning points for me was with Sir Richard when he said, ‘if you recognise qualities in an individual that you admire, that means you already possess those qualities yourself’.”

– © Fairfax NZ News

Source – https://www.stuff.co.nz/business/money/8229750/Perseverance-beats-the-poverty-trap